- #Countabout vs moneydance update#

- #Countabout vs moneydance for android#

- #Countabout vs moneydance software#

- #Countabout vs moneydance free#

The software will even keep an eye on unusual account charges and alert you accordingly.

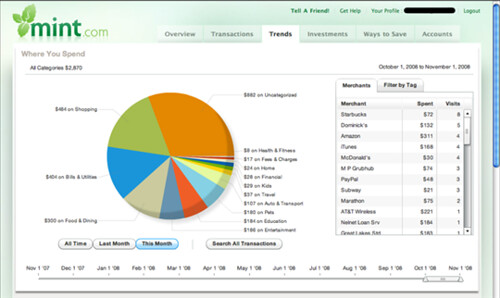

Mint brings together everything in one spot - you can see your income, bills and other expenses all in one space. Quicken and Monydance might feel a little clunky as far as the interface goes, but Mint has a modern UI that makes everything easy to access. It’s laid out in a way that everything is very quick and easy to access. The biggest thing that users coming to Mint might find useful is the user interface. In addition, Mint makes it easy to pay your bills with its online bill pay feature - you can get alerts and schedule payments in the snap of a finger. Create a budget based off of your income and expenses and Mint will offer suggestions to you based on how you spend money. One of the major things that Mint has going for it is its budgeting features.

#Countabout vs moneydance free#

Mint is offered by Intuit, but is entirely free personal finance software.

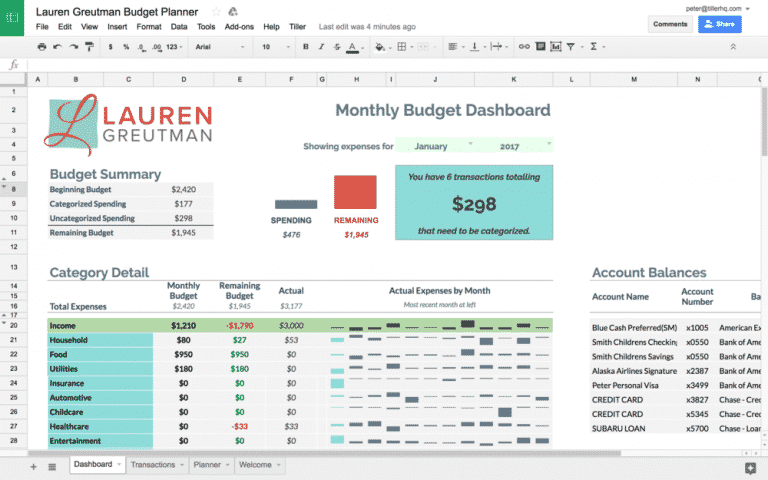

However, the biggest thing Moneydance has going for it is reliable customer support and more stable software, which are two of the biggest complaints that come with Quicken. It’ll run you about $50, which is around the same price as Quicken. Moneydance is really nice because its one of the few pieces of personal finance software that isn’t tied to the Cloud in anyway - it’s largely all based offline. This gives you a detailed look into all of your finances, whether it be your personal income and expenses or your investment funds. an emergency fund account or an account for long-term saving).Īdditionally, you’re able to create graphs and reports with Moneydance. But, you can link both your checking and savings accounts to Moneydance and even create subaccounts (e.g. Moneydance lets you track your bank accounts as well - you can even create one for cash on hand. There are reminders built into the software that even show you past due bills and bills that are upcoming - you’ll never miss a payment again out of forgetfulness! The software also makes it easy to track your credit cards and loans, too. On top of being great personal finance software, it has a robust budgeting system as well, as you can easily track income and individual expenses with Moneydance. With Moneydance, you can view the value of all of your investment accounts and even the performance of how individual stocks and mutual funds are doing. It has support for stocks, bonds, CDs, mutual funds and much more. You can track your investments with the software as well.

#Countabout vs moneydance for android#

Moneydance is a great alternative to Quicken with a ton of different features - online banking (there’s even an app for Android and iOS), bill payment and account management.

#Countabout vs moneydance update#

Follow along below and we’ll show you some alternatives that’ll make managing your finances so much easier (and cheaper)!Įditor’s Note: This is a new update to an article originally published in 2013. However, they’re not for everybody and, depending on the type of Quicken software you have to pick up, it can be quite pricey, too.įortunately, there are plenty of alternatives out there that are perhaps better than Quicken (depending on your situation), cheaper and perhaps even free of charge. Whether you’re keeping track of your own finances, those of your home business or even finances for a local small business, Intuit’s products are a great choice. There’s no pricing for mint as it is entirely free to use and helps you manage all your financial goals in one place.When people are looking for a way to keep track of personal finances, Intuit’s Quicken and Quickbooks applications are generally the go-to software. Mint also offers different reports like net worth, net investment, spending, debts, etc.

Mint automatically classifies all your transactions accurately so that you can know where you are spending.Mint is free to use and very secured with a 256-bit encryption level, and the data exchanged with Mint is secured with 128-bit SSL.Mint also lets you personalize your account by creating budgets, making your bill payments easier, looking for what has been charged, receiving alerts for every transaction, and helping yourself to improve your credit score.Mint helps you stay on your money, bills, and investments by always notifying you of your bills.

0 kommentar(er)

0 kommentar(er)